Cross-Border E-Commerce: Chinese Sellers Navigate Black Friday Headwinds

This roadmap can help you counter challenges that Amazon sellers know too well: fierce competition, shrinking margins, and rising costs

Amazon sellers have often complained about the ultra competitiveness of the platform, but reports from the 2024 Black Friday season indicate that it’s tough all over.

In a watershed moment for Chinese sellers in the global e-commerce landscape, Black Friday and the Cyber Week shopping period has revealed fundamental shifts in market dynamics and business models.

Traditional profit structures are experiencing unprecedented pressure while at the same time, competitive forces are constantly increasing. That has led sellers to fundamentally rethink elements of their cross-border commerce.

To put it simply, it’s becoming clear that a race to the bottom benefits no one.

Market Performance

The current market climate has been particularly challenging for Chinese sellers, with profit margins experiencing dramatic compression across all major categories.

- Yahoo Finance reported profit margins plummeting from over 50% to barely 10-15% across most product categories

- The same report indicated that Guangzhou-based clothing manufacturers’ revenue decreased up to 30% year-over-year on Temu

- Aggressive discounting strategies of 10-20% have failed to generate sufficient volume to offset margin erosion

The Competitive Landscape: It’s Tough All Over

The marketplace ecosystem has undergone significant transformation, primarily driven by the emergence of ultra-discount platforms. Companies like Temu and Shein have fundamentally reshaped consumer expectations through extreme discounting strategies, offering markdowns of up to 90%.

These platforms have normalized free shipping as a standard offering, forcing established sellers to absorb additional costs to remain competitive.

Key competitive challenges include:

- Marketplace algorithms heavily favoring low prices over brand equity

- Rising operational costs on traditional platforms like Amazon

- Increasing pressure from fuel surcharges, labor costs, and last-mile delivery fees

- Growing complexity of platform fee structures and promotional requirements

Advertising and Marketplace Dynamics

Digital advertising continues to dramatically increase in cost, as well as in the level of expertise required to be profitable.

Critical cost factors include:

- Marketing costs on Facebook and Google are trending towards 15-25% year-over-year increases in CPCs

- Declining ad conversion rates due to increased competition and buyer hesitancy

- Reduced targeting capabilities due to evolving privacy regulations

- Substantial increases in warehouse labor costs across global markets

- Volatile shipping rates tied to fluctuating fuel prices

How Sellers Can Adapt

In response to these challenges, sellers are implementing a variety of diversification strategies.

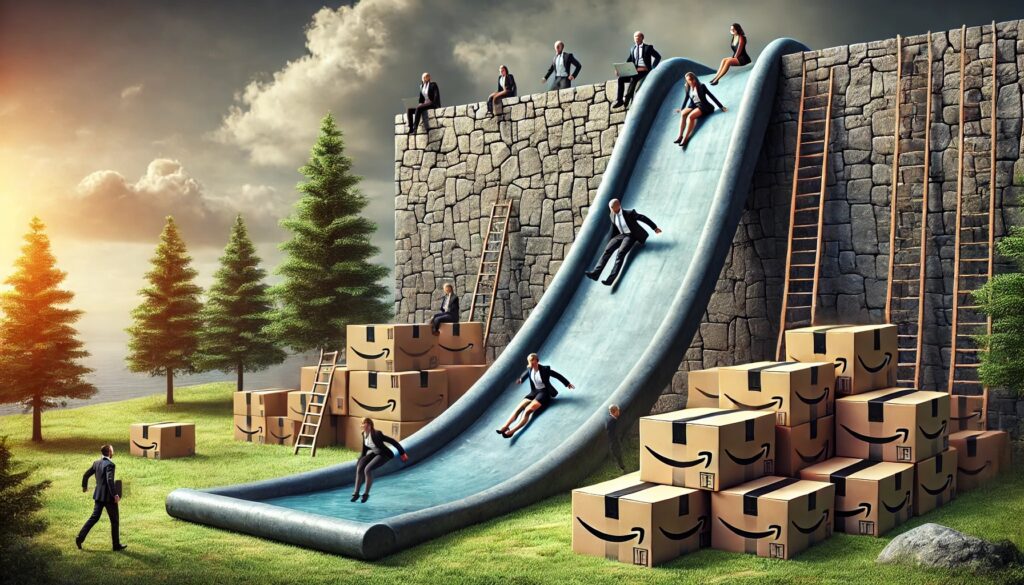

Platform Diversification

- Expansion across multiple marketplaces to reduce platform dependency

- Development of platform-specific product variations

- Implementation of customized pricing strategies per channel

Strategic Listing Portfolio Growth

Product portfolio management has become increasingly strategic, with sellers developing unique SKUs for different platforms and investing more heavily in private label development.

There’s also a notable shift toward higher-margin categories, particularly in electronics accessories, beauty products, and home improvement items.

Innovative Marketing

Marketing strategies have evolved to embrace:

- Social commerce integration through platforms like TikTok and Instagram

- Platform-specific content creation including short-form videos and live streaming

- Extended promotional calendars beyond traditional peak periods

- Staggered discounting strategies to balance volume and margin

Strategic Recommendations for Brand Entrepreneurs

For immediate impact, sellers should prioritize:

- Optimization of cost structures through strategic SKU curation

- Enhancement of inventory management practices

- Development of unique value propositions for competitive differentiation

- Investment in brand building and customer relationship management

Long-term strategic initiatives should focus on:

- Building distinctive brand identities that resonate with target audiences

- Developing direct-to-consumer channels to reduce platform dependency

- Implementing advanced analytics and automated pricing systems

- Strengthening supply chain relationships and operational efficiency

Frequently Asked Questions

Q: What is the minimum viable profit margin for sustainable operations in cross-border e-commerce?

Based on current market conditions and operational costs, sellers should aim for at least 15-20% profit margins to maintain sustainable operations. While some sellers are operating at 10-15%, this leaves little room for unexpected costs or market fluctuations. The key is to balance competitive pricing with operational efficiency to protect margins.

Q: How many platforms should sellers diversify across to optimize risk and opportunity?

Many successful sellers maintain active operations across 2-4 major platforms. This provides sufficient diversification while remaining manageable from an operational standpoint. However, it’s crucial to fully understand each platform’s requirements and audience before expansion, rather than spreading resources too thin across too many channels.

Q: What are the most effective strategies for competing against ultra-discount platforms?

Rather than attempting to match extreme discounts, sellers should focus on differentiation through product quality, unique features, and superior customer service. Building brand identity and focusing on specific niches where price isn’t the primary purchasing factor has proven more sustainable than engaging in price wars with ultra-discount competitors.

Q: How can sellers effectively balance inventory levels across multiple platforms?

Implementing a centralized inventory management system with real-time tracking across all platforms is essential. Start with conservative inventory allocation per platform based on historical data, then adjust based on performance. Consider using third-party logistics providers (3PLs) that can fulfill orders across multiple platforms to maintain flexibility while minimizing holding costs.

Q: What are the key metrics sellers should monitor daily to ensure healthy business operations?

Critical metrics to track include:

- Daily profit margins per SKU and platform

- Advertising cost of sales (ACoS)

- Inventory turnover rates

- Customer acquisition costs

- Return on ad spend (ROAS)

- Platform-specific performance metrics

Next Steps

The challenges facing Chinese sellers in the global e-commerce market represent a structural shift rather than a temporary downturn.

In many ways, it mirrors the uphill struggle that ALL Amazon sellers face from time to time. Success in this new environment demands a fundamental reorganization of business models, with emphasis on operational efficiency, platform diversification, and sustainable brand development.

If you’d like to safeguard your own e-commerce path, do what increasing numbers of Amazon, Walmart, and TikTok’s top sellers have done and reach out to the experts at Canopy Management.

Canopy Management is a full-service marketing agency for Amazon, Walmart, and TikTok sellers. Our team consists of multi-million dollar, omni-channel entrepreneurs, industry leaders, and award-winning experts.

Ready to Start Growing Your Amazon Brand?

Canopy’s Partners Achieve an Average 84% Profit Increase!

Find out more